Estimating the final price of a prescription-only product

At a glance: Pricing for pharmaceuticals in Germany

Supply and demand determine the price, at least considering most branches of a free market economy. This basic principle also applies to non-prescription (over-the-counter) medicines in Germany, although the situation is different for prescription medicines: The process of price formation is far more complicated here and, in addition to competition, is determined by various regulations of the Ministry of Health.

Prescription obligation, patent protection, benefit analysis, reference price clusters, discount obligations, price freezes, markups, pharmacy discounts and discount contracts influence the price of a drug and must be carefully considered when introducing it into the market. Sounds complicated – that’s why we summarise the most important facts for you.

Factors influencing the pricing of reimbursement

The price and reimbursement of ambulatory prescription medicines is initially determined by a central factor: Is it a patent-protected original drug or a generic drug? After patent protection has expired, generics of the patent-protected active substances can enter the market. Their prices are also determined – on the basis of the previously regulated pricing of the original preparations – by competition. The pricing and reimbursement of prescription-only, patent-protected original drugs, on the other hand, is not determined in competition, but on the basis of a wide variety of regulations, which can be broken down into a total of eight factors.

The 8 factors of pricing of prescription-only, patent-protected originator product

1. Benefit analysis

If a medicinal product with new active substances is launched onto the market, the manufacturer himself can determine the price of the medicinal product for the first 12 months. Since 2011, the German Medicines Reorganization Act (Arzneimittel-Neuordnungsgesetz AMNOG) entered into force, which additionally regulates the systematic evaluation of the additional therapeutic benefit of new drugs in order to negotiate the price according to the therapeutic value of the drug within twelve months of market launch (AMNOG evaluation and price negotiation procedure).

To this end, manufacturers are instructed to submit a dossier on the additional benefit of the drug compared to already available supply standards to the Federal Joint Committee (Gemeinsamer Bundesausschuss G-BA) immediately after market launch. On this basis, the G-BA assesses the additional therapeutic benefit of the new drug. The G-BA may delegate the assessment of the benefits and costs of a drug to the Institute for Quality and Efficiency (Institut für Qualität und Wirtschaftlichkeit, IQWIG) or to third parties. By assessing the benefit, the G-BA lays the foundation for the subsequent reimbursement price negotiations between the manufacturer and the German Association of Health Insurance Funds (Spitzenverband Bund der Krankenkassen – GKV-SV). The result of the negotiations between the manufacturer and the GKV-SV is an agreement on the reimbursement amount, which applies from the 13th month after the market launch. The reimbursement amount is the basis for price formation and is supplemented by further price mechanisms. If the patent protection of this new drug expires, it can be offered at a lower price by other manufacturers. On the basis of this competition, the prices of the drug then also fall.

If, on the other hand, no additional therapeutic benefit is found, the new drug is allocated to an existing reference price cluster wherever possible. If the drug cannot be allocated to a reference price cluster, the price is negotiated with the aim that the annual therapy costs of the new drug do not exceed those of the established therapy.

2. Reference price cluster

Reference price clusters are defined by the G-BA and the GKV-S for groups of comparable drugs. The fixed amounts defined for the clusters can be understood as the maximum amounts reimbursed by the statutory health insurance for drugs. These are not fixed prices, but rather a reimbursement limit. Since the additional costs have to be paid by the insured themselves, prices above this fixed amount are rarely charged.

3. Mandatory discounts

In the case of a drug that is not assigned to a reference price cluster, the pharmaceutical companies must grant the health insurance funds a legally prescribed discount on the sales price. This discount is seven percent of the selling price for patent-protected drugs. In the case of generic drugs, the discount is six percent plus a further discount of a maximum of ten percent.

4. Price freeze

In addition, a price freeze for medicines paid for by health insurance funds was established by the Act Amending Health Insurance Law and Other Regulations (Gesetz zur Änderung krankenversicherungsrechtlicher und anderer Vorschriften GKV-ÄndG). This price moratorium was extended until 2022.

5. Pharmacy discount

If the health insurance company pays the costs for a medicament within 10 days, the pharmacy is in the case of a finished medicament obligated to grant the health insurance company a legally determined pharmacy discount of at least 1.77 euro per medicament. In the case of a drug with a fixed amount, the discount is based on this amount. If the selling price is lower than the fixed amount, the discount is calculated on the basis of the lower price.

6. Discount contracts

In addition to the mandatory discounts, health insurance funds and pharmaceutical companies can negotiate further discounts for drugs. On the basis of these discount agreements, the pharmacies exclusively distribute the medicines of the manufacturer with whom the patient’s health insurance company has agreed a discount agreement.

7. Additional charges of pharmacies and pharmaceutical wholesalers

Pharmacies and wholesalers levy surcharges on the prices negotiated by manufacturers and health insurers. On the basis of these surcharges, which are calculated as a percentage of the purchase price and supplemented by fixed surcharges per pack and fixed surcharges to ensure the provision of emergency services, a uniform price for prescription medicines is created – independently of the pharmacy that sells them.

8. Additional drug payment within the statutory health insurance system

For prescription drugs, for which the costs are covered by the SHI, insured persons have to pay an additional fee at the pharmacy. The additional payment is ten percent of the selling price – at least five euros, but no more than ten euros and no more than the price of the drug itself. If it concerns medicaments, which are at least 30 per cent under the maximum reimbursement amount of the reference price cluster in terms of price, the additional payment can be omitted.

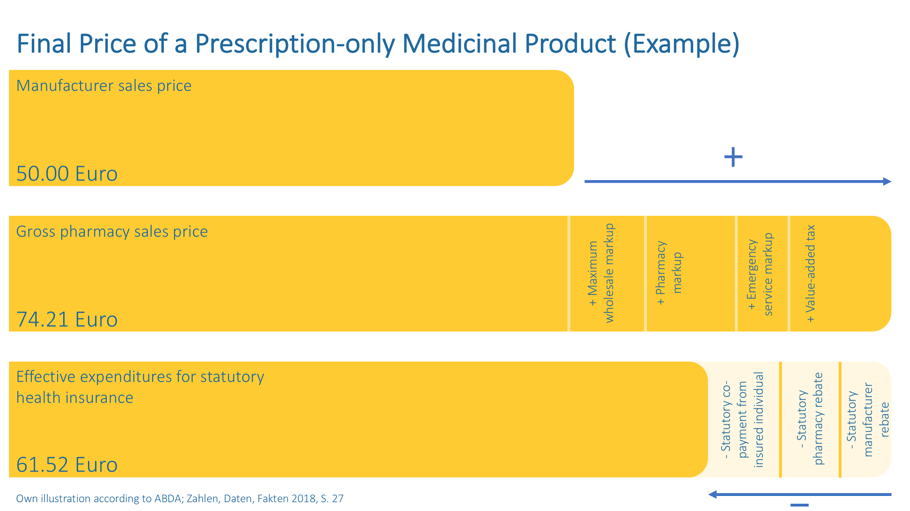

And what does this calculation ultimately look like in practice, how is the pharmacy price determined and what are the actual expenses of the statutory health insurance fund? We have used an example to illustrate this for you:

Pricing of over-the-counter medicines in the pharmaceutical trade

The costs of non-prescription medicines are paid by the patient himself – except in certain special cases where a doctor orders the patient to use them. The Joint Federal Committee determines which drugs are among the exceptional cases and publishes them in the OTC exception list. Since the prices for non-prescription drugs are not fixed, each pharmacist can decide for himself at what price he wants to offer the drug.

Pricing of pharmaceuticals sold as stationary drugs in hospitals

The prices for medicines that are given as in-patient medication to patients in hospitals are negotiated between pharmaceutical companies and hospitals and fully reimbursed by the health insurance fund. However, since the Act to Strengthen the Supply of Medicines (Gesetz zur Stärkung der Arzneimittelversorgung AMVSG) of 2017, this price cannot be negotiated completely freely: The negotiated price at which the drug is sold in the pharmacy is the upper limit for the price that a hospital has to pay the pharmaceutical company for the drug.

The monitoring of regulations, evaluation and price negotiations as well as price developments on the market remains a challenge that takes time. Pharmazie.com supports you! With our iceberg search, we offer a pharmaceutical search engine that searches the ABDA article database, the ABDA database and 20 drug databases with one click. Our drug databases have been developed for healthcare professionals and link current and reliable drug information in a single location. With our innovative database overviews, we offer a service tailored to your needs to make your information search efficient.

To learn more about what conditions a drug must meet to be included in the pool of reimbursable medicines, download our white paper here. Let us know your contact details here. So we can inform you as soon as our new article goes online!

Download all important in our whitepaper

Related Articles

Navigating the Transatlantic Pharmaceutical Landscape: A Comprehensive Analysis of ABDA Standards, FDA Mutual Recognition, and Market Access in Germany (2025)

Executive Summary: The Dual Challenge of Compliance and Strategy The global pharmaceutical landscape of 2025 is defined by a paradoxical dynamic: regulatory harmonization on one hand, and increasing market complexity on the other. For pharmaceutical professionals...

The Strategic Imperative of the Summary of Product Characteristics (SmPC): Regulatory Frameworks, Digital Transformation, and AI-Driven Compliance

Executive Summary The global pharmaceutical ecosystem is currently navigating a period of unprecedented complexity. At the epicenter of this environment—balancing the rigorous demands of regulatory compliance, the clinical needs of healthcare professionals, and the...

Pharmacy Wholesale Drug Prices in Germany: Ensuring Transparency, Access, and Compliance

Pharmacy wholesale drug prices in Germany are a critical concern for international pharmaceutical wholesalers looking to stay competitive and compliant. Germany is Europe’s largest pharmaceutical market, and its drug pricing system is highly regulated – making market...