Pharmaceutical market access in Germany is a critical step for any drug developer aiming to tap into Europe’s largest pharmaceutical market. With a population of 84 million and annual pharmaceutical revenues exceeding €56.9 billion in 2021, Germany offers vast opportunity. However, achieving successful market entry is challenging due to complex regulations, stringent reimbursement processes, and intense data requirements. In this comprehensive guide, we address how pharmaceutical companies can successfully enter and navigate the German pharmaceutical market. We cover all key aspects – from regulatory pathways and the AMNOG reimbursement process to pricing strategies and leveraging data – to help your regulatory, market access, and pricing teams prepare for success.

By the end of this article, you will understand the German market landscape, key hurdles and recent policy changes, and how tools like pharmazie.com can provide time-saving data solutions to streamline your market access strategy. Let’s dive in.

Key Questions on Market Access in Germany

To ensure we cover all relevant user intents, we analyzed common search queries about pharmaceutical market access Germany. Professionals in pharma and biotech often seek information on the following questions:

- Market Landscape: How large and important is the German pharmaceutical market, and why target Germany?

- Regulatory Pathways: What are the requirements to get a new pharmaceutical approved and launched in Germany?

- Pricing & Reimbursement: How does the German pricing and reimbursement system work (e.g. AMNOG process, G-BA assessments, reference pricing)?

- Challenges & Strategies: What hurdles might companies face (e.g. benefit evidence, price controls) and how can they plan to overcome them?

- Tools & Resources: What data or platforms can help market access teams save time and ensure compliance in Germany?

In this article, we address each of these areas with up-to-date insights, so that market access professionals have a complete roadmap for entering Germany’s pharma market.

Germany: Europe’s Largest Pharmaceutical Market

Germany is not only the most populous country in the EU, but also its largest pharmaceutical market by value. In 2021, pharmaceutical sales in Germany exceeded €56.9 billion, outpacing other major EU markets like France and Italy. Germany alone accounts for about 5.9% of the global pharmaceutical market. This sizable market is supported by a robust healthcare system, a high standard of care, and a strong economy. For pharmaceutical companies, a German launch can drive significant revenue and serve as a benchmark for other countries – the German price is often used as a reference in international pricing comparisons.

However, Germany’s attractiveness comes with complexity. The country’s healthcare system imposes stringent regulations and cost controls to manage drug spending. Market access in Germany requires navigating a unique reimbursement framework (the AMNOG process) and understanding local market dynamics. For example, virtually all approved prescription drugs are eligible for reimbursement under the statutory insurance system, meaning Germany has no separate positive formulary – but reimbursement is conditional on undergoing health technology assessment and price negotiations post-launch. This dynamic – a large, open market coupled with rigorous cost-effectiveness evaluation – makes early planning essential. As one industry expert observes, Germany is one of the most attractive markets in Europe due to its size, yet entering it successfully requires understanding a unique set of hurdles in the reimbursement landscape. In the following sections, we’ll break down those hurdles and how to address them.

Regulatory Pathways to Drug Approval in Germany

Gaining market access begins with obtaining regulatory approval for your pharmaceutical product. In most cases, new drugs intended for Germany will be approved through the European Medicines Agency (EMA) centralized procedure, which grants EU-wide marketing authorization. This means that by the time you consider German market entry, your product likely has an EU marketing authorization (or a national authorization via DCP/MRP for generic products). Germany’s national regulatory agency (BfArM or PEI for biologics) will be involved primarily if you pursued a national route or for certain post-approval requirements.

Key regulatory considerations include ensuring your product complies with EU and German laws on manufacturing and pharmacovigilance, and preparing country-specific materials (e.g. German-language labeling, patient information, packaging with safety features). For instance, under the EU Falsified Medicines Directive, prescription drug packages in Germany must include tamper-evident seals and unique identifiers for verification. Ensuring these compliance steps are completed is necessary for your product to be dispensed in German pharmacies.

Another important regulatory aspect is market authorization holder and distribution setup. Pharmaceutical companies often establish a local subsidiary or designate a local representative in Germany. You’ll need to list your product in the directories used by German pharmacies and insurers, such as the ABDATA “Lauer-Taxe” (the master drug database for pricing and reimbursement). Tools like the ABDA database offered by pharmazie.com can help ensure all relevant drug information (e.g. the Pharmazentralnummer or PZN code, pricing data, etc.) is properly registered and accessible to stakeholders. In fact, pharmazie.com’s Drug Pricing Germany database integrates the ABDA Article Master File, providing up-to-date official drug information and pricing for all products on the German market, which is crucial once your product is launched.

Regulatory tip: It’s wise to engage early with German health authorities (when possible) and plan for launch readiness concurrently with your EMA approval. This includes preparing your AMNOG dossier (explained below) even as you finalize regulatory approval. Many companies also seek scientific advice or G-BA consultations prior to Phase III trials to ensure their study designs meet German evidence expectations – a point we will revisit in the context of reimbursement. In short, achieving regulatory approval opens the door, but true market access in Germany depends on clearing the next hurdle: pricing and reimbursement.

Pricing and Reimbursement Framework in Germany (AMNOG and Beyond)

One distinctive feature of pharmaceutical market access in Germany is that, unlike many countries, no explicit pricing or reimbursement approval is required at launch. Upon receiving marketing authorization, a company can introduce a new prescription drug to the German market at a self-determined price, and statutory health insurances will initially reimburse it. But this freedom is short-lived and comes with conditions. Germany has put in place several mechanisms that indirectly regulate drug prices and drive cost containment. These include:

- AMNOG benefit assessment and price negotiation for new innovative drugs (the primary focus for new launches).

- Reference pricing (Festbeträge) for groups of equivalent or similar drugs, capping reimbursement levels for older products.

- Mandatory manufacturer rebates on drug sales to statutory insurers.

- Price freeze (price moratorium) on older drugs, preventing price increases on medications launched before a certain date.

In practice, this means that while you can set an initial price, you must prove your drug’s value quickly to maintain that price or justify a premium. The centerpiece of Germany’s system is the AMNOG process (Arzneimittelmarkt-Neuordnungsgesetz, the Pharmaceutical Market Reorganization Act), which was introduced in 2011 and fundamentally changed how drug prices are determined. Below we break down how AMNOG works and other pricing controls you need to know.

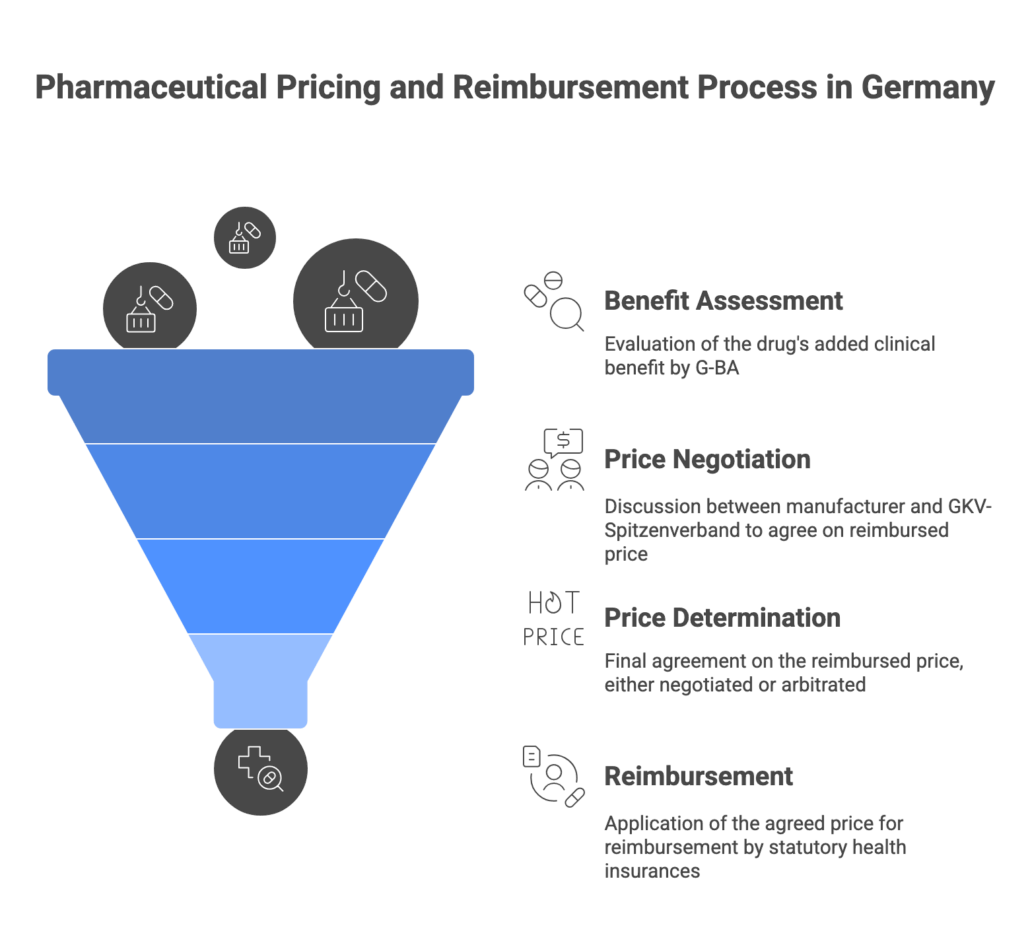

The AMNOG Benefit Assessment Process

For new innovative pharmaceuticals (new active substances) entering the German market, the AMNOG process kicks in immediately at launch. The manufacturer has to submit a dossier to the Federal Joint Committee (G-BA) when the product is first marketed, demonstrating the drug’s added clinical benefit over existing standard therapy. This comprehensive dossier includes clinical trial data comparing the new drug to the appropriate comparator therapy (as defined by G-BA) on outcomes like mortality, morbidity, and quality of life.

The G-BA, with technical support from the Institute for Quality and Efficiency in Health Care (IQWiG), conducts a health technology assessment (HTA) of the new drug over a six-month timeline. This involves evaluating the evidence and determining the level of additional benefit of the new therapy compared to the current standard. Germany uses categorical ratings for added benefit, ranging from “major additional benefit” down to “no additional benefit” or even “less benefit” than comparator. The G-BA publishes its official benefit assessment decision (the degree of added benefit, if any) about six months after launch.

- If a positive additional benefit is found (minor, considerable, or major benefit), the drug remains free-priced for the first months, and the process moves to price negotiation (see below).

- If no added benefit is recognized, the drug is typically assigned to an existing reference price group or a cost limit. In other words, its reimbursement price will be capped at the level of existing therapies. If no appropriate reference group exists, a price will still be negotiated but cannot exceed the cost of the comparator therapy in most cases.

It’s important to note that Germany’s system automatically reimburses new medicines during this initial period, but the outcome of the G-BA assessment has huge implications for pricing. A positive G-BA verdict gives you leverage to obtain a higher price, whereas a “no added benefit” verdict means your product will be treated like a me-too or generic, with likely a much lower reimbursed price. Statistics show a significant share of new drugs receive either “no additional benefit” or only minor benefit ratings, reflecting the high bar set by German HTA. This puts pressure on manufacturers to have robust comparative data and the “right” endpoints to demonstrate value.

After G-BA publishes its assessment, the manufacturer and the National Association of Statutory Health Insurance Funds (GKV-Spitzenverband) enter into price negotiations. These negotiations result in an agreement on the reimbursed price (essentially a discount off the list price) that will apply going forward. Under current law, this negotiated reimbursement price is applied retroactively from the 7th month after launch. In other words, the company is free to set the list price for the first six months, but any difference between that list price and the ultimately negotiated price for months 7-12 must be paid back or credited. This is a recent change implemented by the 2022 reform law (GKV-FinStG) – previously companies enjoyed 12 months of free pricing, but now the free-pricing window is only 6 months.

If the two parties cannot reach an agreement by end of month 6 after the G-BA decision, an arbitration board will set the price, which also takes effect from month 7 post-launch. The negotiated (or arbitrated) price becomes binding for all sales in the statutory insurance market and also for any equivalent follow-on products (e.g. if another company later launches the same active ingredient, it will generally face the same reimbursed price).

Recent updates: The 2022 reform introduced strict “guardrails” for price negotiations to further contain costs. These guardrails impose price ceilings based on the outcome of the benefit assessment. For example, if your drug only showed a minor benefit against a comparator, the negotiated price must not exceed the cost of the comparator therapy. Even with a positive benefit, there are scenarios where the price premium is tightly limited. The idea is to ensure that prices are proportionate to added benefit and that payers don’t end up paying significantly more than existing therapies if the benefit is marginal. Manufacturers need to be aware of these guardrails when formulating their pricing strategy – a high added benefit rating is now more crucial than ever to justify a higher price.

Reference Pricing, Rebates, and Other Price Controls

Aside from AMNOG, Germany employs reference pricing (Festbetrag system) extensively for drugs that are not considered innovative or have therapeutic alternatives. Drugs in the same class or with similar effect can be grouped and a maximum reimbursement level set. If a drug’s price is above that reference threshold, patients must pay the difference out-of-pocket. Many older products (including generics) fall under reference price groups, which effectively forces prices down to a competitive level. If your product is assigned to a reference group (for example, G-BA decides your new drug has no extra benefit and there is an existing group), its price will be constrained by that benchmark unless you can show some differentiating value.

Germany also mandates several statutory rebates that manufacturers must give insurers. Currently, a universal rebate of 7% off the manufacturer’s list price is required for all outpatient drugs reimbursed by statutory insurance (this was temporarily raised to 12% during 2023). Generic drugs carry an additional 10% rebate (with a slightly reduced base rebate) to encourage low-cost generics. These rebates automatically reduce the net revenue companies receive. On top of that, individual insurance funds frequently negotiate further discount contracts with manufacturers for specific drugs (often generics), which can grant a health fund exclusive discounted supply in exchange for higher volume. While rebate contracts primarily affect generic competition, originator companies should be aware of this system’s impact on market dynamics and supply (Germany has even seen calls to reform rebate contracts due to drug shortage concerns).

Another cost control is the price moratorium: Germany has had a price freeze on older drugs (those launched before August 1, 2009) in place for many years. Manufacturers cannot raise the prices of these products beyond 2009 levels (inflation adjustments aside) – a rule recently extended through end of 2026. This doesn’t directly affect new launches, but it exemplifies the general climate: regulators keep pressure on drug prices and look for savings wherever possible.

Special cases: Orphan drugs for rare diseases historically got some leeway – if their revenue stayed below a threshold, they were deemed to have an added benefit by default. However, even this is tightening. The sales threshold for orphan drugs to be exempt from full AMNOG assessment was lowered from €50 million to €30 million annually. This means successful orphan drugs will more quickly face the same rigorous assessment and price negotiation as mainstream products once their sales grow.

In summary, the pricing and reimbursement environment in Germany is complex and highly regulated despite the facade of free pricing at launch. Pharmaceutical companies need to prepare early and thoroughly to navigate the AMNOG process, anticipate negotiations, and understand the various cost control tools (reference prices, rebates, etc.) that will impact their product’s financial performance. The next section will discuss how to surmount these challenges and ensure a successful market access strategy.

Challenges and Best Practices for Successful Market Access

Launching in Germany presents several challenges that market access and pricing teams must proactively manage. Below we outline common hurdles and expert-recommended strategies to address them:

- Demonstrating Additional Benefit: The biggest challenge is achieving a positive G-BA assessment. A relatively high number of new drugs receive a “no additional benefit” outcome, often because the evidence submitted doesn’t meet G-BA’s expectations. Best practice: Plan your evidence generation early. It is crucial to design Phase III trials with German requirements in mind. Engage with the G-BA in early consultations (ideally before Phase III) to confirm the appropriate comparator therapy and relevant endpoints for the German context. For example, G-BA may insist on comparing against an older off-patent drug (the cheapest standard of care) or expect patient-relevant outcomes like quality of life. Aligning your trial design with these expectations can significantly improve your chances of demonstrating added benefit. As one expert notes, early G-BA consultation allows companies to “clarify which evidence requirements are expected… and reduce the risk of derailments during the benefit assessment process.” This foresight can make or break your market access success.

- Data Availability at Launch: Germany demands comprehensive data right at launch, which can be difficult if your Phase III data are still immature or if long-term outcomes aren’t yet observed. There is often pressure to have complete and comparative data by day one of launch. Best practice: Consider strategies like adaptive development – for instance, conducting indirect comparisons or real-world evidence studies to supplement trial data. While G-BA historically has limited use for real-world data, supportive evidence can still help your value story. Also, schedule your global development timeline such that pivotal trial results are available and published by the time of German launch. If data gaps are unavoidable, be prepared to justify them and possibly accept an initial price cut with opportunities to reassess later (though formal re-evaluations in Germany are infrequent except when new evidence emerges or after some years).

- Price Negotiation Dynamics: The negotiation with GKV-SV is a tug-of-war between payer and manufacturer perspectives. German payers often take a “bottom-up” approach, starting from the cost of the comparator and adding a small premium for benefit, whereas companies prefer a “top-down” approach starting from the list price and offering discounts. There’s also now the overlay of guardrail rules strictly limiting the ceiling price based on benefit outcome. Best practice: Go into negotiations with a clear pricing strategy and flexibility. Use health economic models and international reference prices to support your ask. If your drug has substantial clinical benefit, emphasize areas where it may save costs in the health system (e.g. fewer hospitalizations). Conversely, if benefit is modest, be ready with a realistic price that acknowledges comparator costs – pushing too high may trigger the guardrails and arbitration (which you’d likely want to avoid). It’s also wise to have a volume strategy: since 2022, Germany requires agreements on volume-based rebates or caps as part of the price deal. Be prepared to discuss anticipated patient volumes and possibly offer tiered pricing (e.g. lower price beyond a certain sales volume) to address payer budget concerns.

- Staying Compliant with Evolving Rules: German pharmaceutical laws are not static. Recent reforms have added complexity – for example, the 2022 GKV-FinStG law and the 2024 Medical Research Act (MFG). The latter introduced a controversial new option for “confidential” reimbursement prices from 2025 (allowing a privately agreed net price that is not published or visible to pharmacies), essentially enabling two-tier pricing with a hidden discount. It also created pricing incentives for local R&D: if a company conducts a “relevant part” of clinical trials in Germany, certain strict price caps (guardrails) might be waived as an encouragement to invest in German research. Navigating these new provisions requires up-to-date knowledge. Best practice: Keep your team informed on the latest policy changes and engage local legal or market access experts. For instance, understanding the confidential price option could influence your European pricing strategy (it may help avoid international reference price effects if the true price is concealed, albeit Germany attaches an extra 9% rebate cost for this confidentiality). Staying agile in response to new rules (and perhaps leveraging them, like planning some trial sites in Germany to qualify for benefits) can give you a competitive edge.

- Operational and Local Market Factors: Beyond pricing and HTA, practical factors can impede market access. Germany has a decentralized healthcare structure – for example, uptake can depend on physician willingness to prescribe and formularies in hospital settings. Best practice: Support your product’s adoption with a robust launch plan: education for physicians on the benefit (especially if G-BA rating was positive), patient access programs if needed to mitigate co-pay issues, and monitoring of prescription data. Ensure your supply and distribution are ready – partner with local wholesalers and have pharmacovigilance and medical information infrastructure in place locally. Lastly, be mindful of the private health insurance segment (about 10% of Germans) which is not subject to the AMNOG price – but usually, private insurers will also eventually expect the lower negotiated price.

In summary, successful market access in Germany requires early preparation, cross-functional collaboration, and strategic flexibility. Engage regulatory, clinical, health economics, and commercial teams well ahead of launch. By anticipating Germany’s requirements and adapting your strategy (from trial design to price setting), you can turn a challenging process into a manageable one. Many companies that succeed in Germany often treat market access as an integral part of development – not an afterthought.

Leveraging Data and Tools to Streamline Market Access

Managing the wealth of information and ongoing requirements in Germany can be daunting. This is where pharmazie.com’s platform offers significant value for market access and pricing teams. Pharmazie.com is a one-stop solution providing fast, reliable access to over 20 pharmaceutical databases covering the German and international markets. By integrating diverse data sources, pharmazie.com helps companies save time, ensure data accuracy, and make informed decisions. Here’s how leveraging such tools can benefit your market access efforts:

- Comprehensive Drug Data in One Place: Instead of manually gathering information from numerous portals (G-BA publications, federal gazettes, price lists, etc.), pharmazie.com provides consolidated data on all medicines in Germany with a single search. For example, the Drug Pricing Germany database (based on the ABDA Article Master) gives you up-to-date official pricing for every product, including prescription and pharmacy retail prices, reimbursement status, and legal classifications. This database is updated biweekly with new drugs, price changes, and rebate contracts, ensuring you never miss a critical update. Having this at your fingertips means no more scouring multiple sources – a clear time saver for pricing analysts.

- Market Access & HTA Intelligence: Pharmazie.com offers an AMNOG Benefit Assessment Database that compiles all current and past G-BA decisions, IQWiG reports, and even details like the comparator chosen and the outcome (additional benefit level) for each assessed drug. This is incredibly useful for market access professionals – you can quickly research how similar products fared in their G-BA evaluations, what arguments or data were persuasive, and what mandatory discounts were applied. Such HTA intelligence helps in shaping your own dossier strategy and anticipating payer positions. It’s essentially a shortcut to learning from every AMNOG case to date.

- Pricing & Competitor Monitoring: German market conditions change frequently – new competitor launches, reference price group adjustments, or policy changes can occur with little notice. Pharmazie.com’s PharMonitor Germany tool keeps track of market changes for you. PharMonitor provides biweekly reports on changes in the German pharmaceutical market, such as newly introduced products, price revisions, or shifts in distribution status. By subscribing to these alerts, your team can react quickly – for instance, if a generic competitor to your product launches at a low price, you’ll know right away. Additionally, the Transparency List (AVWG) database on pharmazie.com allows detailed comparisons of original brands vs generics and parallel imports, showing how various cost measures (like the German “bonus-malus” rules) affect reimbursement. These insights support your pricing strategy and help identify when a competitor might trigger a reference price change.

- Data Reliability and Compliance: All data on pharmazie.com are sourced from official publications and continuously maintained. For example, official drug price updates from the Lauer-Taxe (the price compendium) are integrated twice monthly. The platform also includes information on legal frameworks – such as prescription requirements, reimbursement eligibility, and relevant laws – ensuring your team stays compliant with German regulations. Rather than worrying if your information is up-to-date, you can trust pharmazie.com as a single source of truth, which is crucial when negotiating with authorities who expect the latest data.

- Integration into Your Systems: Pharmazie.com is built with integration in mind – it offers web services (APIs) and custom data solutions to feed directly into your company’s internal tools. For instance, via pharmazie.com’s web service, you can embed a price lookup or drug interaction check within your own software systems. The platform allows data export in various formats (Excel, CSV, etc.) on a schedule you choose. This means the comprehensive market data can seamlessly plug into your workflows, whether you need to populate your ERP system with current prices or update your CRM with formulary statuses. The integration capacity of pharmazie.com’s tools ensures that valuable market access data is not siloed – it becomes an integrated part of your decision-making pipeline, boosting efficiency.

- Expert Support and Customization: In addition to raw data, pharmazie.com provides expertise in the “networking of drug information.” Their team can offer customized data services and even marketing support for product launches. For example, you might request a tailored report on the four most cost-effective therapies in your drug’s class (a feature of the PZN Individual add-on) or get an analysis of pricing scenarios for an upcoming negotiation. By using these services, pharmaceutical companies can gain deeper insights and present stronger cases to stakeholders.

Bottom line: Leveraging a platform like pharmazie.com empowers market access and pricing teams to work smarter. The benefits translate into time savings, data confidence, and strategic insights. Instead of spending days gathering data or worrying about missing an update, your team can focus on higher-value tasks – analyzing the information, formulating strategy, and engaging stakeholders. Many market access professionals find that such tools pay for themselves by preventing costly errors (like mispricing due to outdated info) and accelerating decision-making. In a fast-moving market like Germany, having the right data at the right time is a competitive advantage. Pharmazie.com offers that edge, along with user-friendly interfaces and support to make the complex German market more navigable.

(For more details on pharmazie.com’s specific offerings, you can explore our internal pages on Databases, Services, and feel free to reach out for a personalized demo.)

Conclusion: Succeeding in Pharmaceutical Market Access in Germany

In conclusion, pharmaceutical market access in Germany demands a combination of careful planning, local insight, and agile execution. Germany’s status as Europe’s largest pharma market makes it enormously attractive, but success is contingent on navigating its unique regulatory and reimbursement landscape. Companies that invest early in understanding G-BA requirements, generating robust comparative evidence, and formulating sound pricing strategies are far better positioned to achieve favorable outcomes. Recent reforms – from stricter price controls to innovative incentive schemes – underscore that the landscape is evolving, and staying informed is half the battle.

The good news is that with the right approach and tools, even this complex market can be mastered. By adopting the best practices outlined (such as early dialogue with authorities, aligning trial design with HTA needs, and preparing for negotiations), pharmaceutical companies can turn German market access into a strategic success. Moreover, leveraging data platforms like pharmazie.com gives market access and pricing teams a powerful advantage. Pharmazie.com’s integrated databases and services provide the speed, reliability, and depth of information needed to make intelligent decisions and avoid pitfalls, whether you’re comparing competitor prices, ensuring compliance, or monitoring policy changes.

Entering the German market is a significant undertaking, but the reward – access to millions of patients and a strong reference market for the rest of Europe – is well worth the effort. With thorough preparation and the support of data-driven solutions, your company can confidently navigate Germany’s pharmaceutical market access process and ultimately secure the pricing and reimbursement needed for commercial success.

Ready to streamline your German market access? As a next step, we invite you to leverage pharmazie.com in your journey. Book a free demo with our experts to see how our tools can be tailored to your needs and help you conquer the challenges of the German market. With pharmazie.com as your partner, you can save time, ensure data accuracy, and focus on what matters most – demonstrating the value of your innovation to German healthcare. Kontaktieren Sie uns today to schedule your personalized demo and take the next step toward successful market access in Germany.