Pharmacy wholesale drug prices in Germany are a critical concern for international pharmaceutical wholesalers looking to stay competitive and compliant. Germany is Europe’s largest pharmaceutical market, and its drug pricing system is highly regulated – making market transparency and up-to-date information essential. This article provides a comprehensive guide to Germany’s pharmacy wholesale drug prices, explaining the regulated pricing structure, the challenges for pharmaceutical wholesale companies, and how tools like pharmazie.com’s data platform offer real-time pricing, regulatory insights, and market access support. By understanding the German system and leveraging integrated data solutions, pharma wholesale Germany and Europe operations can navigate pricing complexities with confidence.

Understanding Pharmacy Wholesale Drug Prices in Germany

Germany’s prescription drug prices are governed by strict regulations to ensure uniform costs nationwide. For pharma wholesale distributors, this means there is limited flexibility in setting prices, as margins are fixed by law. The German Drug Price Ordinance (AMPreisV) – under Section 78 of the Medicines Act (AMG) – fixes the surcharges that wholesalers and pharmacies can add to a manufacturer’s price. In practice, pharmacies and wholesalers apply a regulated percentage markup plus fixed per-package fees (including a fee to fund after-hours pharmacy service) to the manufacturer’s price, resulting in a uniform pharmacy retail price for any prescription medicine. This legal framework guarantees that a given prescription drug will cost the same at any pharmacy in Germany, ensuring transparency and fairness in the supply chain.

For wholesalers, the implication is clear: while competition on service is possible, drug prices for prescription meds cannot be freely undercut beyond the small rebates allowed within the fixed margin. Any company dealing with pharmacy wholesale drug prices in Germany must understand these regulations to stay compliant. Over-the-counter (OTC) drugs, by contrast, are not price-regulated – pharmacies set OTC prices freely based on market factors. However, the bulk of wholesalers’ revenue comes from prescription drugs, which make up ~90% of Germany’s drug sales by value. Thus, mastering the regulated pricing system is paramount for success in the German market.

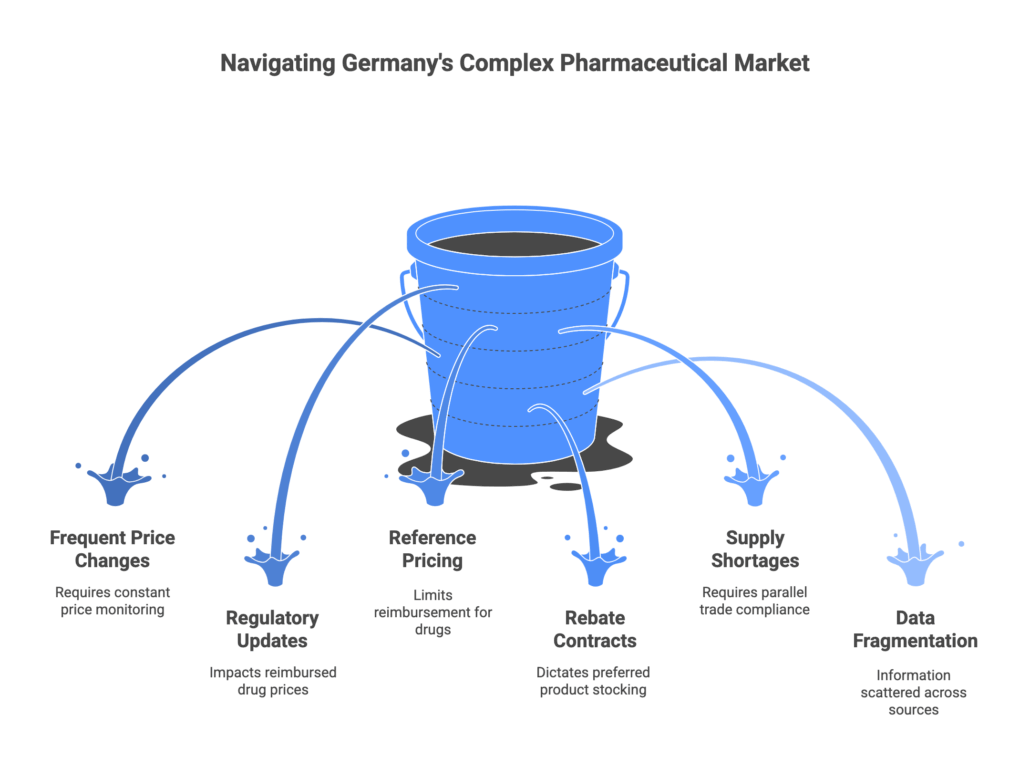

Challenges for International Wholesalers and the Need for Market Transparency

International pharmaceutical wholesalers face unique challenges when engaging with Germany’s market. The country’s pricing system is dynamic and complex, with updates and rules that require constant monitoring:

- Frequent Price Changes: Official drug prices can change up to twice monthly due to new product launches, periodic price adjustments, or changes in reimbursement and rebate agreements. In fact, hundreds of thousands of price changes occur each year in Germany. Tools like pharmazie.com’s PharMonitor service alert users to price changes 3–5 days before they take effect, underlining how frequently prices are updated. Without real-time alerts, a wholesaler could be caught off-guard by a mid-month price drop or increase.

- Regulatory Updates and AMNOG Decisions: Germany’s AMNOG (Arzneimittelmarkt-Neuordnungsgesetz) process evaluates new drugs’ benefits and negotiates their reimbursed prices after launch. In the first 12 months on the market, a manufacturer can set any price for a new prescription drug, but after one year a negotiated reimbursement amount applies based on the drug’s added benefit. If no additional benefit is proven, the drug may be grouped into a reference price cluster (fixed reimbursement group) or face a price cut to match existing therapies. For wholesalers, this means the initial price of an innovative drug might significantly drop after the first year. Keeping track of ongoing AMNOG benefit assessments and outcomes is essential – a negative G-BA (Federal Joint Committee) decision can lead to a sharp price reduction or a fixed reimbursement cap. Wholesalers must anticipate these changes to manage inventory and contracts accordingly.

- Reference Pricing and Reimbursement Ceilings: Many older drugs in Germany are subject to reference pricing (Festbeträge), where insurance will only reimburse up to a certain amount for a group of equivalent drugs. If a wholesaler carries a product priced above the reference ceiling, patients will have to pay the difference out-of-pocket, making that product harder to sell. Thus, knowing which products have reference price limits and what those limits are is important for inventory decisions.

- Rebate Contracts and Discounts: German statutory health insurers frequently enter exclusive rebate contracts with specific manufacturers for certain generic drugs. Pharmacies are then required to dispense the contracted product when available. Wholesalers need visibility into these contracts to stock the correct products. The pricing database on pharmazie.com includes information on rebate contracts and framework agreements, updated biweekly, helping wholesalers ensure they supply the preferred products under insurance agreements.

- Supply Shortages and Parallel Trade: Medicine shortages have become a pan-European issue, and Germany is no exception. The German regulator BfArM maintains a public database of current drug supply shortages, highlighting the importance for wholesalers to have real-time supply data. International wholesalers often mitigate German shortages by importing medicines from other EU countries (parallel trade). Parallel imports exploit price differentials between countries – “in economic terms, parallel import of pharmaceuticals is a consequence of differing price levels within the EU”. While this can be an opportunity (importing lower-priced stock from abroad to sell in Germany at the German price), it requires careful compliance: a parallel importer must hold a license from BfArM or PEI before bringing a drug into Germany. Wholesalers engaged in pharma wholesale Europe operations must constantly compare international drug prices and monitor where products are available cheaper. Market transparency is crucial here – one must know, for example, if a cancer drug is significantly cheaper in France this quarter, or if a UK supplier has surplus stock of a medicine facing shortages in Germany.

- Language and Data Fragmentation: Another challenge is that official information is scattered across various sources (regulatory websites, price lists like the Lauer-Taxe, health insurance notices, etc.) and often only in German. Cross-country data is even more fragmented. The EU has initiatives like the EURIPID database for authorities to share pricing info, but industry stakeholders do not have direct access. This fragmentation means a wholesaler without an integrated tool might juggle multiple websites, PDF lists, and databases to get the full picture – a time-consuming and error-prone process.

Why does transparency matter? For an international wholesaler, every pricing detail and update in Germany can affect profit margins and legal compliance. Missing a price change could mean selling at a loss or violating the fixed price law; missing a new reimbursement rule could mean stocking a drug that patients can’t afford due to copays. In a market as regulated and dynamic as Germany’s, real-time transparency is directly linked to operational efficiency and competitive advantage. This is where a comprehensive platform like pharmazie.com becomes invaluable.

How pharmazie.com Simplifies Pharmacy Wholesale Drug Prices in Germany

Pharmazie.com is a data platform designed to make Germany’s pharmaceutical market more transparent and accessible for industry professionals – including wholesalers. Described as “all pharmaceutical information in one place”, pharmazie.com integrates over 30 databases covering drug prices, product details, clinical information, and regulatory data. For a pharma wholesaler, this means that instead of consulting separate sources, you can rely on a single, unified interface to get the latest pricing and market intelligence. Below are key pharmazie.com features and how they address wholesaler needs:

Integrated Drug and Pricing Databases

One of pharmazie.com’s core strengths is its integrated drug pricing database for Germany, built on the official ABDA Article Master (also known as the “Lauer-Taxe” pricing data). This database provides comprehensive, up-to-date pricing information for all medicines sold in German pharmacies, including prescription and OTC drugs. Every two weeks, it’s updated to reflect new product entries, price revisions, and any changes from regulators. With pharmazie.com’s Drug Pricing Germany tool, wholesalers get details like: current pharmacy retail price, pharmacy purchase price (wholesale price), the unique product code (PZN), available package sizes, and even legal classification (e.g. prescription-only, narcotic) of each product. Complex price calculations, such as those involving value-added tax or special case pricing (e.g. **N1/N2/N3 package sizes, different wholesale markups), are handled by the system – ensuring accuracy for billing and quoting.

Crucially, pharmazie.com doesn’t stop at German data. It includes international drug databases covering 50+ countries. An international wholesaler can search for a drug by its active ingredient or trade name and find out where it’s marketed abroad, under what name, and often the pricing or reimbursement status in those markets. This global reach is a boon for parallel import/export strategy. “The best [thing] in pharmazie.com is always to know which product is marketed in which country,” says one pharmaceutical wholesaler who relies on the platform daily. Having side-by-side German and international drug info means you can quickly identify alternative sources or substitute products, then obtain the necessary contact details for the manufacturer or local supplier through the integrated address database. In short, pharmazie.com’s databases provide a one-stop, multilingual resource for drug prices and product data, saving wholesalers from searching multiple national databases or translating documents.

Real-Time Price Changes and Supply Insights

To maintain a competitive edge, wholesalers need to react quickly to market changes. Pharmazie.com addresses this with real-time monitoring tools. The PharMonitor Germany feature tracks every price change, product launch, or distribution status change in the German market, and notifies users 3–5 days before the change officially takes effect. For example, if a manufacturer announces a price increase effective next month, PharMonitor will flag it so you can adjust purchasing or warn your pharmacy clients in advance. These bi-weekly reports on price changes are delivered automatically via email, ensuring you never miss an update. By reacting ahead of time, wholesalers can order stock before a price hike, or conversely, deplete inventory before a price drop erodes value.

Beyond prices, pharmazie.com also provides data on product availability. Integrated references to BfArM’s shortage lists and distribution status in the ABDA database let you see if a drug is marked as temporarily not deliverable or if it’s back-ordered by suppliers. During the recent surge in supply bottlenecks, such information has been vital. With pharmazie.com, if a certain medication is reported in short supply, you can quickly look up possible alternative products (e.g. generics or parallel imports) and see their prices and stock status – all in one platform. This real-time supply insight helps wholesalers maintain service levels to pharmacies and hospitals by sourcing substitutes when primary products are unavailable.

AMNOG Benefit Assessment Access

Staying informed on regulatory access in Germany is easier with pharmazie.com’s dedicated AMNOG Database. This database gives wholesalers a window into the otherwise hard-to-obtain details of each drug’s health technology assessment outcome. At a glance, you can retrieve the dossier submission, IQWiG’s evaluation, G-BA’s final decision, and the negotiated rebate (discount) agreements for new drugs. For instance, if you want to know whether a recently launched oncology drug received an “added benefit” rating or not, and what price concession the manufacturer had to make, the AMNOG Database has that information compiled. It even shows the European price comparisons that were considered during price negotiations. For wholesalers, understanding a drug’s reimbursement status and price ceilings post-AMNOG can guide strategic stocking. A drug that failed to show added benefit might have to align to a low reference price – meaning its margin could shrink. By using pharmazie.com’s AMNOG insights, international wholesalers can anticipate such shifts and align their portfolios (for example, focusing on alternative therapies if one drug’s price is cut dramatically). In essence, pharmazie.com brings regulatory intelligence (normally scattered across G-BA publications and industry reports) into one searchable hub.

Comprehensive Interaction and Safety Checks

While pricing is the focus, wholesalers also benefit from pharmazie.com’s extensive drug safety databases. The platform incorporates the ABDA “CAVE” database, which checks for drug interactions, contraindications, allergies, and other patient-specific risk factors. Why is this relevant to wholesalers? Primarily, it adds value to the services you offer. For example, when supplying to pharmacies or clinics, a wholesaler using pharmazie.com can double-check if a recommended substitution is clinically safe (e.g. no harmful interactions or allergy alerts for the alternative drug). It can prevent inadvertently suggesting a medication that, while available and priced well, might not be suitable for certain patients. Moreover, if your wholesale operation includes any direct dispensing or hospital supply, the CAVE check is an extra layer of quality assurance. Impressively, this functionality is available as a web service API for integration into your own IT systems. That means you can programmatically run interaction checks or safety screenings on your product catalogue. By ensuring medication safety through built-in checks, pharmazie.com helps wholesalers uphold pharmacovigilance standards and support their clients (pharmacies and healthcare providers) in making safe choices.

APIs and 24/7 AI Support for Wholesalers

Pharmazie.com is not just a web interface – it’s a digital ecosystem that can slot into your workflows. For large international wholesalers, the ability to integrate data is crucial. Pharmazie.com offers API access to many of its databases (for instance, pricing data, supplier contacts, and the CAVE interaction service). This means your internal software (ERP, inventory management, or procurement system) can pull data from pharmazie.com in real time. For example, you could integrate the pricing API to automatically update your catalog prices every two weeks, or use the drug database API to enrich your product listings with the latest descriptions and identifiers like PZN codes. Such integration ensures you are always in sync with official data without manual updates.

In addition, pharmazie.com provides an AI-powered chatbot as a 24/7 support tool. Branded as ChatSmPC/ChatPIL, this AI chat service has been trained on official drug documents (Summaries of Product Characteristics, etc.) and can answer questions about medications instantly. Wholesalers can leverage this in two ways: internally, your staff can get quick answers on product details or usage (for example, querying a storage requirement or a formulation detail at any hour); externally, if you embed a customer-facing chatbot on your portal (via pharmazie.com’s custom AI), you can offer your pharmacy clients instant answers about the products you distribute – improving customer service without 24/7 human staff. The AI chat is “available around the clock” and provides reliable, up-to-date drug information drawn from pharmazie.com’s trusted databases. This feature helps wholesalers handle inquiries faster and more efficiently, whether it’s checking if a drug is gluten-free or confirming the latest contraindications from an updated label.

Staying Competitive and Compliant with pharmazie.com

In summary, navigating pharmacy wholesale drug prices Germany requires both granular market knowledge and the right tools. Germany’s market combines strict pricing laws with frequent changes – a combination that can trip up even experienced international wholesalers if they rely on outdated methods. The key to success lies in market transparency and responsiveness:

- Stay Informed: By centralizing pricing, product, and regulatory data, pharmazie.com ensures that you always have the most current information at your fingertips. No more surprises from an unnoticed price change or a new policy – the platform’s integrated databases and alerts keep you informed in real time.

- Stay Compliant: Using pharmazie.com can help demonstrate due diligence in compliance. You can quickly verify that your pricing aligns with German regulations (thanks to built-in calculations per AMPreisV), and ensure any parallel imports or exports are properly licensed and equivalent. The platform’s direct links to official data (e.g., via BfArM and AMNOG databases) provide confidence that your decisions are based on authoritative sources. By having AMNOG evaluation access and up-to-date legal classifications for each drug, you reduce the risk of missteps in a tightly regulated environment.

- Stay Competitive: Market data is competitive intelligence. With pharmazie.com, wholesalers can identify opportunities such as cheaper supply sources in Europe, emerging generics that could undercut a brand, or high-demand drugs facing shortages where quick action secures stock ahead of rivals. The ability to run price comparisons between original brands, generics, and reimports in Germany (via the platform’s Transparency List tool) is especially useful – you can see the cost differences and any patient co-pay or insurer refund implications at a glance. This helps in optimizing your product offerings and advising customers on cost-saving alternatives. Moreover, by automating data integration and leveraging the AI chatbot for customer queries, you can operate more efficiently, passing on better service (and potentially better prices) to your clients.

In a landscape where information is power, pharmazie.com gives international wholesalers a powerful advantage. It distills the complexity of pharma wholesale Europe and Germany into actionable data – from real-time drug pricing and supply status to deep regulatory insights – all on one platform. This enables wholesalers to make informed decisions quickly, protect their margins, and meet the needs of German pharmacies and healthcare providers reliably.

Conclusion: Germany’s pharmaceutical market may be challenging to penetrate, but with the right data and tools, international wholesalers can thrive. Embracing a solution like pharmazie.com not only demystifies pharmacy wholesale drug prices in Germany but also provides the ongoing support needed to remain compliant and competitive. Pharmazie.com helps international wholesalers stay informed, streamline their operations, and ultimately deliver better value in the German and European drug markets.

Ready to transform your market approach? Explore pharmazie.com’s platform through a free demo or trial today to see how integrated pricing data, regulatory insights, and AI-driven tools can empower your wholesale business. Don’t let Germany’s complex pricing system hold you back – leverage pharmazie.com to turn complexity into opportunity.