In the pharmaceutical industry, having timely and accurate reimbursement data is crucial for successful market access across Europe. Especially in Germany, Austria, and Switzerland (DACH), you face a patchwork of pricing systems and databases. Navigating these can be challenging without a comprehensive solution. The German AMNOG framework in particular has set high standards for evaluating new drugs’ benefits and negotiating prices, influencing practices in other countries. An AMNOG reimbursement database Europe-wide would empower you to make informed decisions by unifying these fragmented data sources. Recent expert voices echo this need: the European Parliament has called for “more transparency throughout the pharmaceutical system, especially regarding pricing components, reimbursement criteria and the actual (net) prices of medicines in different Member States”. In this article, we provide an expert overview of the AMNOG process, compare DACH pricing and reimbursement databases, highlight common data access challenges, and show why pharmazie.com offers the most complete solution for AMNOG reimbursement data in Europe.

Understanding the AMNOG Reimbursement Pathway in Germany

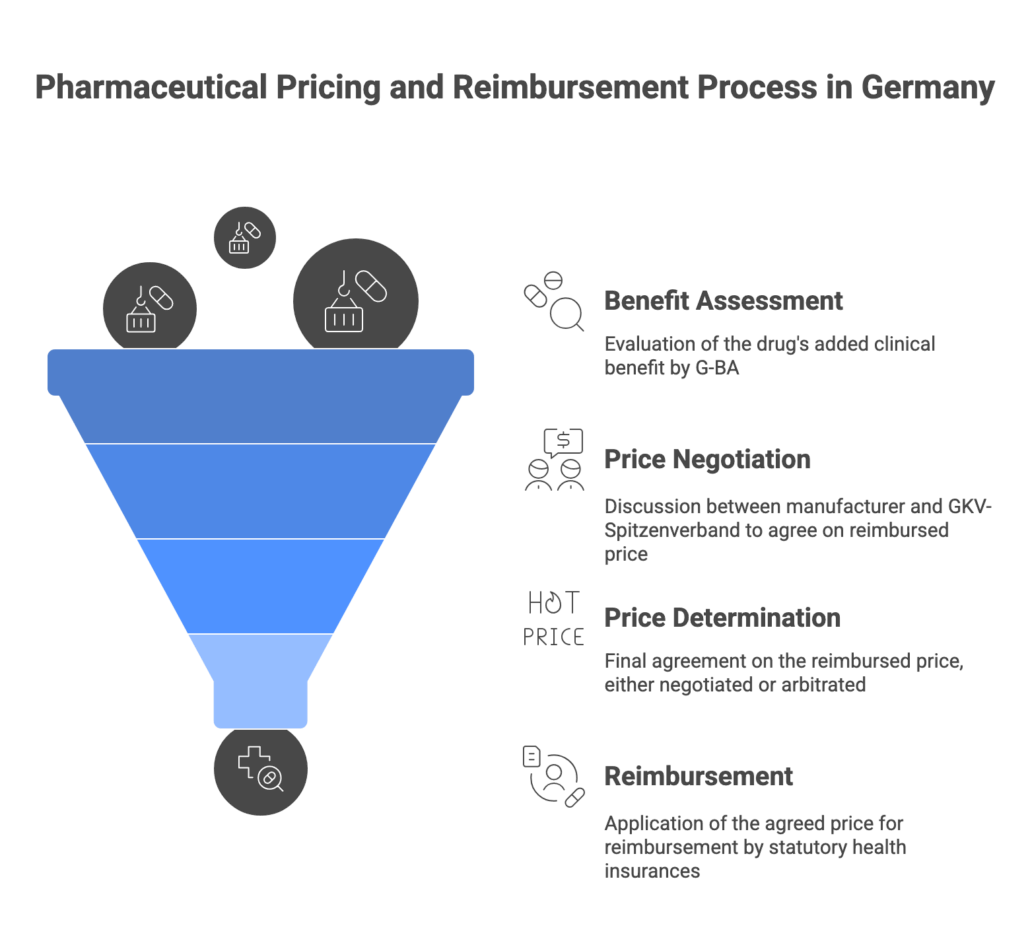

The AMNOG process (Arzneimittelmarktneuordnungsgesetz) is Germany’s rigorous pathway for assessing new medicines and determining their reimbursed price. It consists of two phases: (1) Early Benefit Assessment and (2) Price Negotiation. When a new drug launches in Germany, the manufacturer may set an initial price for the first 12 months. During this period, the drug undergoes an early benefit assessment conducted by the Federal Joint Committee (G-BA), often with input from IQWiG (the German HTA institute). The manufacturer submits a detailed dossier at market entry, proving the drug’s additional benefit over the current standard of care (the appropriate comparator). The G-BA evaluates clinical evidence and, by month 6, issues a decision on the added benefit level – rated in categories like major, considerable, minor, none, or less benefit.

Outcome and impact: The G-BA’s benefit verdict directly shapes pricing. In the subsequent negotiation phase, the manufacturer and the National Association of Statutory Health Insurance Funds (GKV-Spitzenverband) agree on a reimbursement amount (Erstattungsbetrag) within the next 6 months. If the drug demonstrated significant added benefit, you can negotiate a price above the cost of the comparator. Without added benefit, the law mandates the price be capped at the level of the most cost-effective alternative – often meaning alignment with generic or reference-priced therapy costs. In practice, a new drug with no proven added benefit is grouped into reference price clusters or faces a deep price cut, ensuring payers don’t overspend. The negotiated reimbursement price takes effect at month 12 post-launch, after which the drug’s official price in Germany reflects this agreed amount. (If no agreement is reached, arbitration sets the price retroactively, avoiding uncertainty.)

This AMNOG reimbursement pathway has become a model in Europe for evidence-based pricing. More than a decade on, it is “considered to be very detailed and scientifically sound”, and other EU countries closely watch G-BA decisions when crafting their own assessments. However, for manufacturers, health insurers, and other stakeholders, tracking all these decisions and the resulting prices is labor-intensive. Each G-BA resolution and negotiated price is published (e.g. in the Lauer-Taxe drug price compendium), but these are spread across various sources in German. You often find yourself sifting through G-BA press releases and databases to get the latest status of a new medicine in Germany’s market.

European Pricing and Reimbursement Databases – An Overview

Every European country maintains its own databases and lists for drug pricing and reimbursement. Below we provide an overview for Germany, Austria, and Switzerland, illustrating how fragmented the landscape is and why a unified AMNOG reimbursement database Europe-wide is so valuable.

Germany: AMNOG Data and Price Lists

In Germany, a wealth of data exists, but not in one place. Key sources include:

- G-BA AMNOG Decisions: The G-BA publishes each benefit assessment outcome and rationale on its website (in German). These documents detail whether a drug has an added benefit and the extent, but you must manually pull each PDF for details. There is no single public “AMNOG database” for all decisions in a searchable format for outsiders.

- Negotiated Price Information: Final reimbursement prices for AMNOG-assessed drugs are recorded in industry databases like the Lauer-Taxe (a comprehensive drug price list used by pharmacies). The Lauer-Taxe (part of the ABDA Article Stamm) is updated biweekly with all price changes, including the new negotiated prices after AMNOG. However, it is accessible mainly via paid subscriptions or licensed tools – not freely on a government website. This means if you are not a pharmacy or don’t have access to such databases, obtaining the current price requires additional effort.

- Other German Databases: Germany also has reference price group lists (Festbetragsgruppen) published by the GKV and resources like the Gelbe Liste and Rote Liste® directories, which provide drug information and some pricing data. While useful, these are separate silos. For example, Gelbe Liste online might show a drug’s retail price, but not the confidential rebate agreements.

Limitations in Germany: Without an integrated tool, you would need to consult multiple sources – G-BA for benefit info, Lauer-Taxe for the latest price, perhaps Rote Liste for product details – to piece together the full picture of a drug’s reimbursement status. Even the AMNOG-Monitor, an independent analysis platform, notes it compiles early benefit assessments and negotiated prices, highlighting that specialized databases exist but are focused only on Germany. For cross-border work, the German data alone isn’t enough. Moreover, much of the information is in German, requiring translation for non-German colleagues. This siloed approach can lead to missed updates or misinterpretation, which is risky in such a fast-moving market.

Austria: EKO and Austria-Codex

Austria’s pricing and reimbursement data are centered around the Erstattungskodex (EKO), the Austrian reimbursement code. The EKO is essentially Austria’s positive list of medicines that are reimbursable by the social health insurance. If a medicine is listed in the EKO (in the “Green box”), it must be reimbursed by insurers for outpatient care (patients pay only a small prescription fee). The EKO database (available via an online portal in German) indicates each drug’s reimbursement status: whether it’s unrestricted (green section), restricted (yellow section – requiring prior approval under certain conditions), or not yet included (red section). It also provides the official prices and any reimbursement criteria.

In addition to the EKO, the Austria-Codex (a pharmaceutical index published by the Austrian Apotheker-Verlag) contains detailed information on all medicinal products in Austria, including their prices and clinical info. Many pharmacists and physicians use the Codex (or its online version) for day-to-day reference. However, the Codex is a separate resource from the EKO in terms of access and purpose: Codex provides product details and list prices, while the EKO confirms if and how a product is paid for by insurers.

Limitations in Austria: The data is available but fragmented between sources. You might check a product in Austria-Codex to get its details and list price, then cross-check the EKO list (or an EKO2go app) to see if it’s reimbursed and under what conditions. This dual step is time-consuming. Moreover, Austria uses external reference pricing for new medicines – prices in the EKO are set based on the EU average or reference countries. For you, this means having insight into prices beyond Austria is important when launching there, but the EKO itself won’t show you those reference country prices. Again, the lack of an English interface or integrated multi-country view can slow down regional market access work. If you operate in DACH, you need to gather Austrian data in parallel to German and Swiss data and reconcile differences in format and language.

Switzerland: Spezialitätenliste and Beyond

Switzerland maintains the Spezialitätenliste (SL) – a list of pharmaceutical specialties that are reimbursed by the mandatory health insurance. The SL, published by the Federal Office of Public Health (BAG), includes the approved price (ex-factory and pharmacy retail price) for each listed drug and any special reimbursement conditions. The SL is essentially a positive list like Austria’s EKO. If a drug is on the SL, it’s covered, subject to Switzerland’s co-pay rules. Data from the SL can be accessed via the BAG website (with search functions in German, French, and Italian) or via downloadable files. The BAG updates the SL whenever prices are adjusted or new drugs are added. Switzerland periodically conducts price reviews (comparing Swiss prices against a basket of European countries and therapeutic alternatives) to decide if a price should be lowered – those decisions lead to SL updates typically every few months.

For more detailed drug information, Swiss healthcare professionals often rely on databases like PharmIndex or the compendium.ch database, which provide product monographs, similar to a Swiss PDR. PharmIndex (Galenica) also includes Swiss pricing data. But if you are comparing across borders, note that Swiss prices are in CHF and include a pharmacy margin in the retail price.

Limitations in Switzerland: Swiss pricing and reimbursement info is quite transparent via the SL, but cross-referencing it with other countries is not straightforward. The SL is published in the national languages; if you’re not fluent in German or French, you may need translation for some terminology. Additionally, details like whether a temporary supply shortage exists for a product or if an alternative can be imported might require consulting separate sources (e.g., Swissmedic or pharma news sites). Without an integrated system, a market access manager has to monitor the BAG announcements for SL changes and separately keep an eye on European price benchmarks that Switzerland might consider in their reviews.

Common Challenges in Reimbursement Data Access

Collating pricing and reimbursement data across Germany, Austria, Switzerland (and beyond) is a time-consuming task rife with challenges:

- Fragmentation of Sources: As shown above, each country has its own databases, formats, and portals. You end up juggling G-BA dossiers, national formularies, price lists, and perhaps manual Excel trackers. There is no single European portal for all this information (while EURIPID exists for authorities, it’s not open to industry). The World Health Organization noted in 2022 that “EURIPID provides an example of a value-adding initiative for countries to voluntarily participate in data sharing that promotes price transparency.” However, EURIPID’s access is restricted to authorities, leaving pharma companies and insurers on their own to gather data from each nation.

- Language and Format Barriers: Data might be publicly available, but often only in the local language or as unstructured PDFs. For example, the details of an AMNOG decision are published in German, and Austria’s EKO online tool is German-only. Without native understanding or translation, critical nuances (like reimbursement restrictions or patient subgroup definitions) can be lost. Additionally, formats vary – one country site might allow CSV export, another might be a PDF list, another just a web form interface. Integrating these into your internal systems is a headache.

- Keeping Data Up-to-Date: Prices and reimbursement statuses change frequently. Germany sees price changes every two weeks in the official lists. Switzerland and Austria periodically update their lists with new inclusions or price revisions. If you rely on manual checks, it’s easy to miss a change. A new reimbursement restriction or a price reduction could occur, and if your data isn’t updated in near-real-time, you might base decisions on outdated information. The risk of working with stale data is high – for instance, quoting a price to a client or budgeting for a therapy only to find out the price was cut last month.

- Lack of Pan-European Perspective: Perhaps the biggest challenge is the inability to easily compare across countries. Market access and pricing teams often need to perform international reference pricing analysis – “What is the price of our product in Germany vs. Austria vs. Switzerland (vs. rest of EU)?” Without a unified database, this means opening multiple files and websites. One industry investigation highlighted that European governments themselves are “pitted against each other, unaware of what others really pay” due to confidential discounts and siloed information. If even payers struggle with transparency, companies face the same issue when trying to benchmark and strategize. You, as a pharma stakeholder, need a way to see the full picture at a glance – something that piecemeal national systems don’t provide.

- Workflow Inefficiency and Errors: The manual collation of data not only consumes valuable time but also raises the chance of error. Copy-pasting numbers from one source to another, or relying on memory of a recent change, can lead to mistakes. These errors can have serious consequences (e.g., submitting wrong pricing in a tender or misinforming patients about coverage). Ensuring data integrity across sources is difficult without automation. In short, the traditional approach can feel like reinventing the wheel for each query, whereas an integrated approach would let you focus on analysis rather than data gathering.

These challenges underline why a comprehensive AMNOG reimbursement database for Europe is more than a luxury – it’s become a necessity for efficient and transparent market access operations.

Why pharmazie.com Is the Most Complete AMNOG Reimbursement and Pricing Solution in Europe

To overcome the challenges above, pharmazie.com provides an all-in-one platform that stands out as the most complete reimbursement and pricing solution in Europe. When you use pharmazie.com, you benefit from an extensive integration of databases and tools tailored for the DACH region and beyond:

- One-Stop Access to 25+ Databases: Pharmazie.com brings together national drug databases from over 50 countries in one interface. This includes the core DACH references – the German ABDA database (with information on over 50,000 German medicines and international products), the extensive drug database in pharmazie.com (German: Die umfangreiche Arzneimitteldatenbank in pharmazie.com) which covers sources like Gelbe Liste and Rote Liste®, the Austria-Codex, and the Swiss PharmIndex. All these are interlinked, allowing you to search by a single drug name or code and retrieve harmonized data across countries. For example, a search by Pharmazentralnummer (PZN) will pull up that product’s details in Germany and also show if the same product (or ingredient) exists in Austria or Switzerland. This eliminates countless hours of jumping between systems – you get the full picture on one screen.

- Integrated Pricing and Reimbursement Data: Pharmazie.com’s modules ensure you always have the latest prices and reimbursement statuses. The platform includes a Drug Pricing Germany tool that mirrors the official ABDA price updates every two weeks, so you’ll see current ex-factory and pharmacy retail prices, including any recent changes due to AMNOG negotiations or new reference price groups. For Austria and Switzerland, pharmazie.com pulls in the latest data from the EKO and SL, respectively, so Austrian reimbursement categories and Swiss list prices are up-to-date. You can even compare prices side by side across countries. There’s also a German Transparency List (Transparenzliste) module, which compares original vs generic prices and highlights how reference pricing or discounts affect patient co-pays. This kind of comparison tool is invaluable for quickly identifying cost-saving alternatives or preparing arguments for pricing negotiations.

- AMNOG Benefit Assessment Database: A highlight of pharmazie.com for market access teams is the built-in AMNOG database covering all of Germany’s G-BA benefit assessments. Rather than manually searching G-BA archives, you can simply use this module to get a one-glance overview of all ongoing and completed AMNOG procedures – including the submitted dossier, IQWiG’s assessment, the G-BA’s final decision on added benefit, and even the negotiated reimbursement price that was set. Crucially, pharmazie.com provides this information in English as well, so if you are an international team member, you can understand Germany’s outcomes without delay. The AMNOG database is updated after each G-BA plenary meeting (typically monthly), meaning new decisions (and their implications) are added in a timely fashion. No more waiting or translating – you can react immediately to, say, a competitor’s drug that just failed to show added benefit. This module essentially serves as the AMNOG reimbursement database Europe has been longing for, as it bridges German data to a broader context (even listing European reference prices considered during German negotiations).

- Supply Shortages and Alternative Medicines: Beyond pricing, pharmazie.com recognizes the impact of drug availability on reimbursement (an unavailable drug can force use of a higher-priced alternative). The platform includes a dedicated, constantly updated supply shortage database (Lieferengpässe Deutschland und alternative lieferbare Arzneimittel). You get daily updates on reported drug shortages in Germany and can instantly find alternative products that are available. This feature is extremely useful for wholesalers and hospital pharmacists: for instance, if a reimbursed medicine is in short supply, pharmazie.com can help you identify an equivalent substitute (maybe a different brand or an import from abroad) that ensures continuity of care. By integrating this with pricing info, you’ll also see if the alternative has a different reimbursement status or cost. In practice, this can save you from supply disruptions turning into financial losses or therapy gaps. (The database even goes beyond 85% of typical listings, giving a truly comprehensive view of affected products.)

- Real-Time Updates and Alerts: Pharmazie.com keeps you informed proactively. You can set up alerts or utilize RSS feeds for changes such as new price updates, new G-BA decisions, or newly announced shortages. For example, pharmazie.com’s PharMonitor service provides notifications of price changes ahead of their effect date (getting insights 3–5 days before official implementation). This means you could know about an upcoming price reduction or increase before it hits the market – precious time to adjust your strategies. Such real-time awareness is impossible if you’re manually checking PDFs once a month. With pharmazie.com, you stay one step ahead.

- User-Friendly Interface and Search: Despite aggregating massive data, pharmazie.com is designed for ease of use. You don’t need to be a data scientist to query it. The interface supports searches by drug name, molecule, ATC code, or national code (like PZN or ATC in Austria), and then presents results in a clear, standardized format. There’s even an “Eisbergsuche®” (iceberg search) feature to answer complex queries quickly by searching across many fields. The result: you ask once and get all relevant information, instead of running multiple searches in different national systems.

- Workflow Integration (APIs and Export): Recognizing that pharma companies and insurers have their own IT systems, pharmazie.com offers web services and APIs to pull data directly into your internal tools. Whether you have an internal dashboard for international pricing or an ERP system for your pharmacy network, pharmazie.com can feed it the latest data, eliminating manual data entry. This ensures that your whole organization works off the same up-to-date information. For instance, a health insurance fund could integrate pharmazie.com to automatically update its internal formulary lists with the latest reimbursement prices and available alternatives, improving accuracy in claims processing.

- Comprehensive Clinical Support: In addition to reimbursement data, pharmazie.com provides clinical decision support modules (like interaction checks, contraindication alerts via the ABDA database CAVE module). While this may not seem directly related to pricing, it adds context for you as a user. You can see not just the cost of a medication, but also critical usage information. This holistic approach means when evaluating a drug for formulary inclusion, you have both the economic data and the clinical safety data at your fingertips. It’s a complete picture – something especially useful for insurers and healthcare providers who balance cost with patient safety.

In summary, pharmazie.com addresses the pain points by providing the extensive, integrated platform that the DACH pharmaceutical market has long needed. It combines the depth of local data (like German AMNOG details) with the breadth of a European overview. As a result, you save time, reduce the risk of error, and can make truly transparent market access decisions. It’s no surprise that many in the industry turn to pharmazie.com as an essential tool. Dr. Marcel Rossmy, Head of Pharma Supply Chain at Critarion AG, for example, noted that using pharmazie.com enabled his hospital team to quickly find international alternatives for unavailable drugs, thanks to the integrated databases and the platform’s “quick and good service”. This is the kind of value that goes beyond what standalone country databases or static lists can offer.

Conclusion – Achieve Transparent Market Access Decisions with pharmazie.com

In the complex world of European pharma pricing, an AMNOG reimbursement database Europe can rely on is the key to transparent and efficient market access. The AMNOG process in Germany taught the industry the importance of robust data – from demonstrating added benefit to securing the right price – and that lesson applies across borders. To succeed in Germany, Austria, Switzerland and the wider European market, you need more than isolated data points; you need a panoramic view of the pricing and reimbursement landscape. Pharmazie.com delivers exactly that: a unified platform where you can instantly find up-to-date reimbursement prices, compare across countries, check a drug’s AMNOG outcome, and even see if a medicine is in short supply. By using pharmazie.com, you equip yourself to make decisions with confidence – whether you are pricing a new therapy, negotiating with payers, or managing a formulary.

Transparent market access decisions are within reach when you have transparent data. With pharmazie.com, you are no longer navigating the dark by piecing together scattered information. Instead, you have a single source of truth for European drug pricing and reimbursement at your fingertips. This not only boosts your efficiency but also enhances the fairness and consistency of your decisions, ultimately benefiting patients who rely on timely access to medicines.

Ready to transform how you handle pricing and reimbursement data? We invite you to experience pharmazie.com first-hand. Book a personalized product demo of pharmazie.com to see how our integrated AMNOG modules and price databases can empower your daily workflow. Discover the difference that true data integration makes – and join the ranks of pharmaceutical companies, wholesalers, and insurers across DACH who have gained a competitive edge with pharmazie.com’s solutions.